Massachusetts Housing Market 2023 Report

What’s the Massachusetts Housing Market Like

The state of Massachusetts's real estate market is being directly impacted by recent economic events. The sharp rise in interest rates, inflation, and the recession.

Much like the rest of the country, the Massachusetts real estate market has been doing quite well for years and is now showing signs of cooling off.

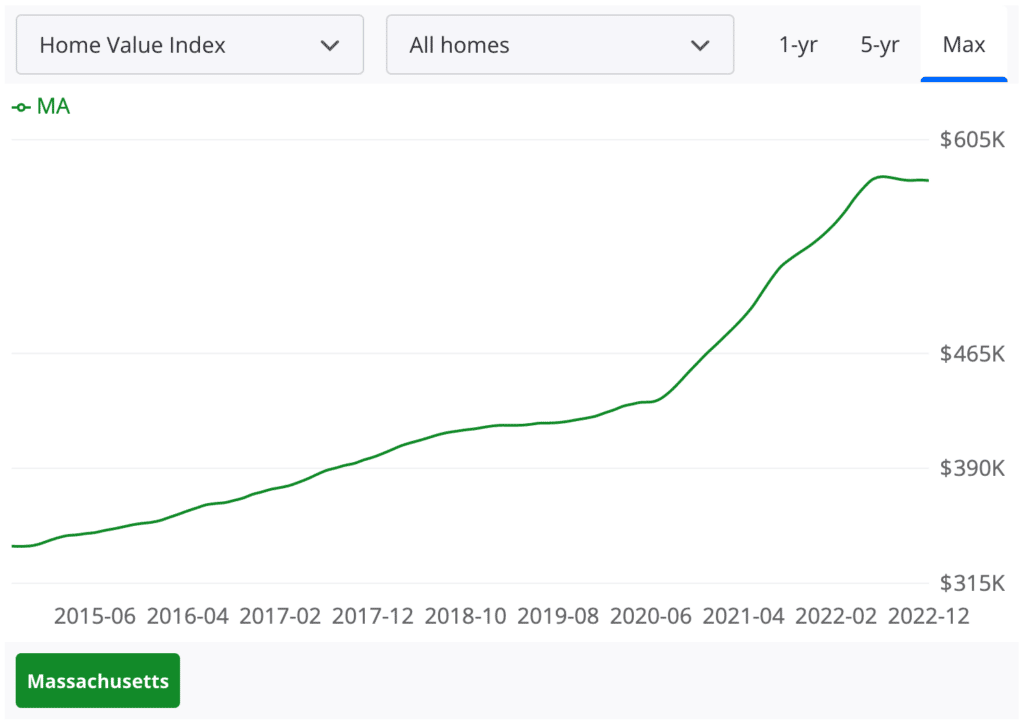

Massachusetts’s median sales price as of Sept 2022 was $568,800. If we look back at Sept 2019’s median price of $421,000, we can see the increase in median price has gone up 35.1% in three years, which is an 11.7% annual growth rate. The rate of price increases for the last three years is a little over twice the normal historical price growth rate nationally.

Looking back at the median home price over the last three years, prices peaked in June 2022 at $612,400. It is clear that the recent steep rise in mortgage rates has curved sales activity and shrunk affordability resulting in a drop in home prices and sales.

Sales volume has also dropped considerably year over year. In Sept 2022, 6,915 homes and condos changed hands in the state of Massachusetts, a 19% decrease from Sept 2021, when 7,202 homes and condos were sold.

The number of sales over the last three years peaked at 9,940 in June 2021; compared to Sept 2022’s numbers, Massachusetts is down 30.4% in the number of sales from the peak of the last three years. Relatively speaking, this is a significant drop in sales which is a reflection of the impact of the pandemic, rising interest rates, and the now looming recession.

How Does The Massachusetts Housing Market Compare to the National Housing Market?

The Massachusetts housing market is facing a similar environment to many other states. There are many similarities in the trend of home prices and the number of sales at the state and national levels.

When we compare national stats to the state of Massachusetts, we find that for September 2022, year-over-year prices in Massachusetts are up 7.9% compared to the national average of 7.6%. Home sales decreased 19% in Massachusetts compared to 22% nationwide. So the sales numbers are quite similar, and prices went up at about the same pace as the rest of the US.

Hottest Real Estate Markets in Massachusetts

There are some markets in Massachusetts that have performed well and continue to do so in the currently changing economy. We are going to look at 5 areas where the numbers are hotter than others in the state.

- Watertown

- Andover

- Marlborough

- Yarmouth

- Newton

Watertown

Watertown is part of the Greater Boston area of Massachusetts and it’s located in Middlesex County. The town has a long history since it was one of the first colony settlements organized by the Puritan settlers in the early 1600s.

The quaint town has grown to a population of approximately 35,000 residents. The town is home to the historic Watertown Arsenal which produced military weapons and other supplies from early 1800 through World War II.

The real estate market in Watertown is very competitive in terms of demand at this time, which indicates a seller’s market. The median home price in Watertown in Sept 2022 was $850,000, which was up a robust 21.9% from Sept 2021.

In Sept of 2022, there were 23 homes sold in Watertown, a 17.9% decrease in sales from the same period in 2021. Looking back at the last 3 years, sales peaked in Jan 2021 at 55 sales.

The median days on the market is 30, which indicates a seller's market. Compared to Sept 2021, the median days on the market have gone up by 36.4%.

Watertown’s median price has gone up 29.5% over the last 3 years and is only down 2% from the peak of June 2021.

Andover

Andover is located 20 miles north of Boston and is one of the many cities on the east coast rich in history and heritage. The town was settled close to 400 years ago, 378 to be exact.

Andover has attracted household brands such as Raytheon, Verizon, and Hewlett-Packard. Andover also boasts having its health share of million dollar earners. The population of the city is approximately 36,500.

As may be expected, due to the long history of the town, the architecture is eclectic and very classic.

The Andover market is currently considered very competitive. The median home price in Andover for Sept 2022 was $792,050. Andover had a year-over-year median price increase of 17%, almost 3 times the national YOY increase in median price. The median price for the city peaked at $905,000 in April of 2022.

In Sept 2022 there were 56 homes sold in Andover, a 12% increase from the prior year. The median days on the market is 21, and it’s up by 19 days compared to last year, a 10.5% increase.

In Andover, there are two positive trends, yea-over-year median price and number of sales are both up.

Marlborough

Marlborough is another historic town established over 350 years ago with a current population of approximately 42,000 residents. The citizenry tends to be on the affluent side with a median household income of $83,469 which is about 24% higher than the national median.

Marlborough is currently a somewhat competitive Real Estate market, slightly favoring home sellers. The median price of a home in Sept 2022 was $480,000, up 12.9% from Sept of 2021. Over the last 3 years, July 2022’s was the peak of the market at a median price of $550,000.

In Sept 2022, 51 homes were sold in Marlborough, which is the same number as Sept of 2021. Looking back three years, the peak in the number of sales was June 2021, with 65 home sales for the month.

Median days on the market in Sept 2022 were 21, which is down 5 days from Sept 2021. Due to the small market size in Fairbanks, there are significant fluctuations in the number of sales and days on the market from month to month.

What we can see that is quite positive about Marlborough is that prices are up from last year, as well as the number of home sales.

Yarmouth

Yarmouth is located in the Cape Cod region of the US. The population of Yarmouth is approximately 24,000. Yarmouth is known for its beautiful beaches, historical attractions, and family-friendly amenities.

Yarmouth is still considered a very competitive market. The median price of a home in Sept 2022 was $487,500, up 10.8% from Sept 2021. The peak of housing prices in the last three years happens to be Feb 2022, when the median price reached $555,000.

There were 64 homes sold in Yarmouth in the month of Sept 2022, a 114.67% decrease from Sept 2021. The peak in the number of sales was in Aug 2020, when 102 homes were sold for the month.

The median days on the market in Sept 2022 was 16 days, the same as Sept 2021.

Newton

Newton is a city with a population of approximately 89,000 residents located about 7 miles west of Boston. Newton is one of the most sought-after places to live in Massachusetts, unfortunately, the price tag of homes is on the upper side so it is a bit expensive and unaffordable to many.

The real estate market in Newton is currently a very competitive market favoring home sellers overall. The median price of a home in Sept 2022 was $1,280,000, an increase of 9.4% from Sept 2021. Over the past three years, Newton homes have gone up 32.4% for an average of 10.8% yearly price growth.

70 homes sold in Sept 2022, down 13.6% from Sept 2021. Looking back over the past 3 years, sales peaked at 170 in June 2021.

The median days on the market have increased from 20 days in Sept 2021 to 22 days in Sept 2022, up by 2 days.

Higher Mortgage Rates Could Slow Price Growth in Massachusetts

How will interest rates affect the housing Massachusetts housing market? The state of Massachusetts’s housing market will likely follow a similar trend as the rest of the country. There are no outlying circumstances that would make the state’s market more or less vulnerable to mortgage rate fluctuations.

As of early November 2022, the 30-year fixed rate mortgage is above 7.25% on average. The Feds just announced yet another .75% increase to the Federal Funds rate, which means a higher cost of borrowing in many areas. Although not necessarily tied to mortgage rates, an increase in rates in business loans, credit cards, etc. puts additional pressure on budgets, ultimately impacting how much house someone can afford.

Future speculation on Massachusetts home prices is a bit risky, but if things keep going the way they have gone so far, Massachusetts will probably not have a dramatic home price correction unless mortgage rates go significantly higher.

Key Market Stats for the Massachusetts Housing Market:

As of the latest compiled housing report with data through Sept 2022.

- Median price: $568,800 - up 7.9% from 2021

- Existing home sales: 6,915 - down 19% from 2021

- Median days on the market: 22, up 4.8% from 2021

Massachusetts Historic price changes & affordability

The Massachusetts housing market has seen steady and moderate appreciation for years. Over the last 3 years, homeowners saw their homes appreciate by 35.1% in 36 months, or 11.7% yearly, which is in line with the national pace of growth.

The steep rise in mortgage rates has shrunk affordability across the nation. Fortunately, the Massachusetts average wages are slightly higher than the national average, which will help soften price correction.

Key Takeaways

- The housing market has started shifting nationwide. Massachusetts has not seen break-neck appreciation; therefore, it is likely that prices will hold relatively steady with only modest declines, although year-to-date home value numbers seem concerning.

- Real Estate markets are highly local, and even within the same state, there will be areas that are projected to be hit hard by the market shift, and others will fare better.

- Timing the market for buying or selling is a big gamble. If it makes sense for you to buy, go ahead and buy a home. For sellers, if you have to sell in the next 12-24 months, you may want to consider doing it sooner than later, especially if you are in an area that may be considered overvalued and has a high potential for house prices to drop.