US Housing Market 2023 Report

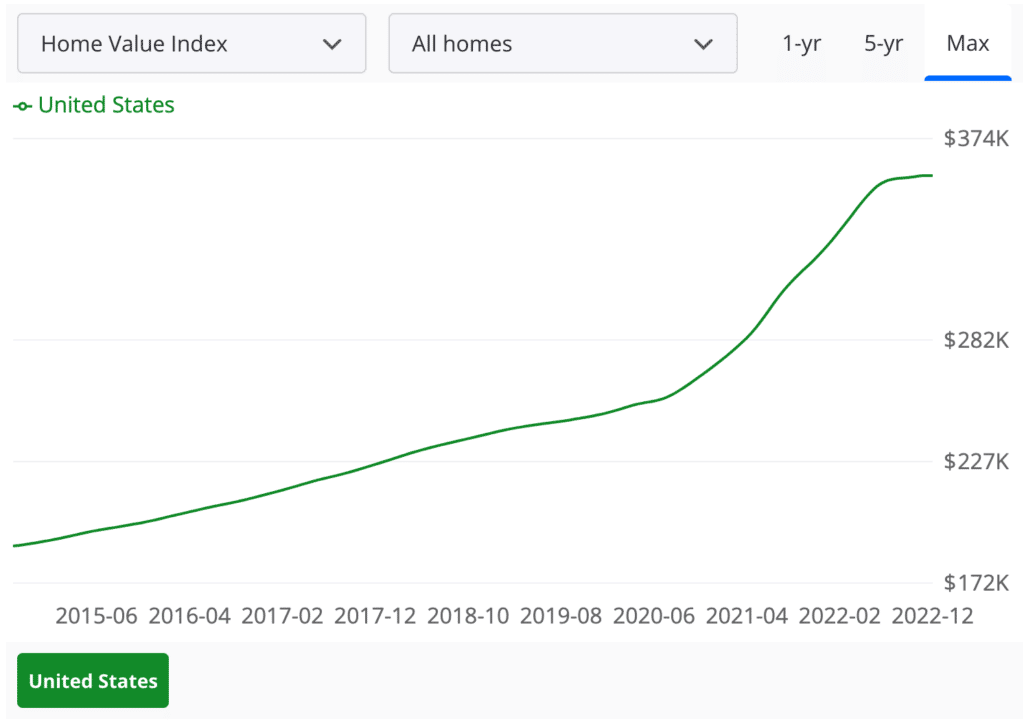

The past two years have been a wild ride for the real estate market nationwide. Home prices surged to new heights in the wake of the COVID-19 pandemic. As more Americans than ever started working remotely, allowing them the freedom to move to the area of their choosing independently of their place of employment, and interest rates stood near historic lows, the demand for housing far outpaced the available inventory. Many house hunters, particularly first-time homebuyers who did not benefit from the equity built in previous property, have found themselves priced out of the market as bidding wars, bypassing typical contingencies to make an offer more attractive for sellers, and multiple offer situations became the norm in many markets nationwide.

However, signs seem to indicate that the white-hot housing market we have witnessed recently has come to an end. In addition, would-be home buyers must contend with high property prices and galloping inflation, which affect their buying power.

Although market predictions are always an exercise of caution, here are some of the leading trends we can foresee for the real estate market in the United States in 2023: the housing market is likely to decline, but prices are unlikely to crash owing to the severe housing shortage.

The Housing Market is Heading Toward a Correction

One of the main concerns of both current and prospective property owners is the sustainability of the high property values we have witnessed in the past two years, bearing no slight resemblance to a housing bubble.

Housing Prices Remain High

The median home price has jumped every month in 2022, reaching a record high of $413,800 in June before falling slightly to $389,500 in August, according to the National Association of Realtors (NAR).

Part of the reason behind the slightly decreasing property prices may be seasonal, as spring and summer mark the height of the real estate market in most of the country. However, the combination of high interest rates and high property prices is already showing signs of affecting the demand as would-be buyers find themselves pushed to the sidelines.

The total existing-home sales decreased for the seventh consecutive month in August by 0.4% from July and reached its lowest level since May 2020. On a year-over-year basis, sales decreased by 19.9% in August, and these trends are likely to continue into 2023. According to the Mortgage Banker Association, purchase loan applications are running about 23% lower than they were at this time a year ago, indicating that many households are putting their home-buying plans on the back burner as mortgage prices remain unaffordable and the prospect of an economic downturn could put their finances in jeopardy.

Increasing Interest Rate Likely to Affect Housing Prices

In an effort to fight back against the 40-year-high inflation, the Federal Reserve has initiated an aggressive interest hike policy. At the time of writing, interest rates for a 30-year fixed-rate mortgage are hoovering north of 6.5%, over twice as much as a year prior, reaching levels unseen in 20 years. As of October 2022, the Federal Reserve had already proceeded to three consecutive 75 bps interest rate increases, with more likely in the work.

Therefore, the price of borrowing money to buy a house is expected to keep growing accordingly, making the current property prices unsustainable. “A household earning the median annual income of $71,000 and using a 20% down payment could afford a home priced at $448,700 in January 2022 when rates were 3.1%,” says Realtor.com’s manager of economic research, George Ratiu. “In contrast, at a 7% mortgage rate, the same household can only buy a $341,700 home.”

Housing Market Likely to Become More Balanced

Experts predict that property prices will likely go down as the demand softens. Reckless behaviors, such as offers over the asking price and bypassing financing and appraisal contingencies, may soon become a thing of the past. According to Goldman strategist and economist Jan Hatzius, the housing markets most affected by property price increases during the pandemic, such as Arizona, the Carolinas, Idaho, Georgia, Florida, and Nevada, are also the most vulnerable. “Existing home sales and building permits have fallen more sharply this year in regions where they increased the most in the earlier part of the pandemic, suggesting that the recent declines have also reflected the partial retreat of a pandemic-related boost to housing demand,” he said in a memo.

The extent of the property value decline varies widely depending on the expert questioned. While some predict that the housing market will crash in 2023, most forecast that property values will remain strong in most of the country. However, the double-digit growth we have seen in the past year is behind us, and prices will likely either increase at a much more moderate pace or decline slightly.

Although lower property prices may be music to the ears of buyers priced out of the current market, not everyone rejoices at this perspective. The severe economic repercussions of the previous housing bubble burst in 2007-2008 are still fresh in many people’s minds.

The Housing Situation in 2023 is Different From 2008

The housing market collapse during the Great Recession caused properties to lose over 20% of their value from their peak in mid-2006, with some markets showing declines as high as 40 to 50%, causing an estimated 8.8 million borrowers – 10.8% of all homeowners – to carry a negative balance in their home by 2008, according to S&P Global Ratings. The median sales price for homes nationwide peaked at $234,080 in June 2006 before plummeting 33% to a low of $156,000 by February 2012, according to data from Realtor.com. There is no denying that the current scenario seems eerily familiar and may lead some to fear similar far-reaching consequences.

High Lending Standards Protect the Housing Market

However, the financial health of the average homeowner in 2022 is very different from the years following the Great Recession. The skyrocketing property values of the early 2000s were powered by predatory lending practices encouraging prospective homebuyers to borrow more than what they could safely afford. As a result, not only did homeowners find themselves owing significantly more than what the property was worth, but they were not in a position to afford their mortgage payments in the first place, leading to a wave of foreclosures. According to real estate data, there were over 3.7 million completed foreclosures as a direct result of the Great Recession. As low-priced distraught properties flooded the market without finding takers, property values overall dwindled.

Meanwhile, lending standards have become significantly more stringent in recent years to avoid a similar situation. According to the Federal Reserve Bank of New York, the typical credit score for mortgage borrowers in the third and fourth quarters of 2021 stood at a record high of 786, and the typical credit score for mortgage borrowers in the first quarter of 2022 was slightly lower at 776. Meanwhile, a mere 10% of approved borrowers had credit scores below 674. In contrast, the median credit score of mortgage borrowers in the years leading to the housing bubble of 2007 fell as low as 707.

Foreclosures are Unlikely to Flood the Housing Market

The highest possible credit score in the FICO system is 850, and a score higher than 740 is considered excellent. Although a high credit score does not guarantee that the borrowers will not default on their payments, it is generally considered a sign of financial health. Therefore, it is unlikely that the property owners who purchased a house at the height of the market will fall behind on their mortgages by large amounts.

In consequence, the chances that we will observe waves of foreclosures similar to the ones of the Great Recession are small, even if property values were to decline due to the lower demand.

The Lack of Real Estate Inventory is Likely to Keep Housing Market High

Another significant difference between the Great Recession and the current housing market is that the main factor that has led to skyrocketing property values is the gap between supply and demand.

As remote workers gained location flexibility in the wake of the pandemic and brought the benefit of their high-paying salaries into lower-cost areas, local home values increased accordingly. In addition, institutional investors flushed with cash also started purchasing lower-priced single-family properties, pricing out buyers looking for a starter home. However, as unfortunate for would-be homebuyers as this storm of circumstances may be, it is only the tip of the iceberg when it comes to a housing shortage that long predates the pandemic.

Severe Housing Shortage

According to a recent Realtor.com study, experts estimate a deficit of over 5 million homes in the United States – up from 3.84 million in 2019. The demand for new housing is simply not keeping up with the offer.

According to the US Census Bureau, 12.3 million American households were formed between January 2012 and June 2021. Millennials have entered their prime first-time home-buying years and constitute the bulk of house hunters, with 43% of current prospective homebuyers, according to the NAR. After years of living with roommates or family as they settled into their careers, they are actively looking for single-family homes better suited to their changing needs, such as more space for children or dedicated home offices to accommodate their remote work obligations. However, these new households are having major issues finding a property that suits their needs.

Traditionally, older individuals sold their properties as they reached their golden years, preferring the security of sharing a home with their children in a multi-generational household or downsizing to an apartment or independent care facility. However, many Baby boomers prefer to age in place for as long as possible, reducing the inventory of houses for sale.

Builders Cannot Fill the Gap in the Housing Market

In addition, new houses – particularly starter homes – are not being built fast enough to keep us with the demand. Single-family home construction bottomed down in the wake of the Great Recession in 2008. As the economy recovered, it started ramping up again but remains at its slowest running pace since 1995.

Home builders have been facing increasing difficulties securing buildable lots, building materials, and qualified workers. In addition, they must contend with zoning restrictions and local opposition (a.k.a. the NIMBY crowd) that made building new homes in desirable higher-density areas increasingly challenging. Therefore, most builders prefer to focus their efforts and resources on more profitable higher-end homes.

Although higher interest rates are likely to cool down the demand, they may also have an adverse effect on the available inventory. For home buyers who purchased their homes with near-historic low interest rates or refinanced their property during the same period, the perspective of starting the process again with significantly higher interest rates is nothing to look down upon. As their buying power could be affected despite the equity they acquired in their previous home over the past couple of years, it would not be surprising if some homeowners decide to postpone selling their property until the interest rates decrease again. As it stands, the NAR estimates that the existing-home inventory was 12% lower than it otherwise would have been when mortgage rates increased in 2018.

Key Takeaways

- The demand is likely to decrease as interest rates increase, bringing down the sky-high property prices we have observed in the past two years.

- It is unlikely that the real estate market will collapse as current homeowners are financially secure.

- The United States suffers from a significant housing shortage that predates the pandemic, which is likely to keep property prices relatively high.